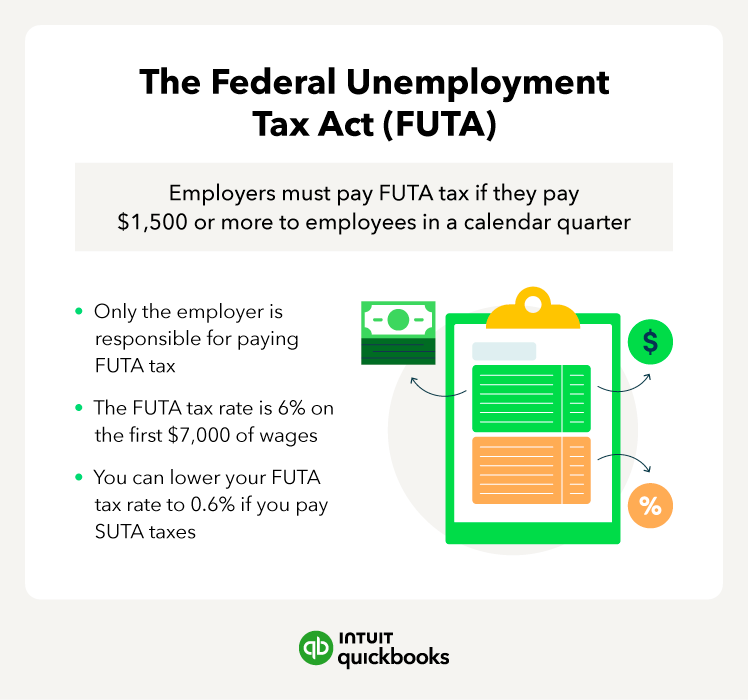

FUTA definition: The Federal Unemployment Tax Act (FUTA) establishes a payroll tax, known as the FUTA tax, that employers must pay. The FUTA tax rate is 6% on up to $7,000 in wages for each employee.

When you lose your job, you can file for unemployment benefits. These benefits are a temporary income that supports you while you search for a new job or start a business . But where does this money come from? All federal unemployment insurance is funded by a payroll tax called the Federal Unemployment Tax.

Below, we’ll cover the FUTA definition, why it’s important, and how to calculate it. We’ll even give you some tips on how to effectively manage FUTA taxes as a small business owner.

As a small business, you’ll have to pay the FUTA payroll tax if your employee wages total $1,500 or more in a quarter.

The FUTA tax rate is 6% on the first $7,000 of an employee’s wages—and if you pay state unemployment taxes, your business is eligible for a tax credit of up to 5.4% to lower your FUTA tax rate to 0.6%.

Passed in 1939 in response to the Great Depression, FUTA provides federal and state governments with money for programs, such as unemployment insurance. FUTA is the responsibility of only the employer and is not a payroll deduction for employees as they do not pay this tax.

The State Unemployment Tax Act (SUTA) is essentially FUTA on the state level. It’s a payroll tax that many states impose on employers to fund state unemployment insurance and other employment programs.

The SUTA tax rate ranges from 2% to 5% of each employee’s salary, depending on your state.

Calculating FUTA taxes is a straightforward process. If everyone at your company earns more than $7,000 per year, the basic equation for determining FUTA tax is as follows:

$7,000 x 0.06 x Number of employees = FUTA tax liability

For example, say you run a company with 20 employees and each employee earns $50,000 per year.

Since everyone makes over $7,000 per year—and FUTA tax only applies to the first $7,000—we can calculate your company’s FUTA payroll liability with the following formula:

$7,000 x 0.06 x 20 = $8,400

Your company’s FUTA tax liability is $8,400. Depending on the state your business is in, you may also owe state unemployment taxes and get a credit to lower your FUTA tax rate.

Your equation will differ if you have one or more employees who make less than $7,000.

Let’s say you run a company with 10 employees—eight employees earn $40,000, one earns $6,500, and one earns $4,000.

Here’s how to calculate your FUTA taxes if you have a mixture of employees making above and $7,000 a year:

Depending on the state your business or employees are in, you may also owe state unemployment taxes.

You’ll make your FUTA tax filings via Form 940 annually, but will likely need to make payments via the IRS’ Electronic Federal Tax Payment System (EFTPS) quarterly.

You need to file a Form 940 if you meet either of these conditions:

The general deadline for filing Form 940 is January 31.

The frequency that you’ll need to make FUTA tax depends on your FUTA tax liability—if your FUTA tax is:

The quarterly deadlines for making your FUTA tax payments are January 31, April 30, July 31, and October 31.

Similar to FUTA, the Federal Insurance Contributions Act (FICA) is another payroll tax for businesses. The main difference between FUTA and FICA lies in the rates who pays each, for example:

FUTA and FICA fund different programs. While money for FUTA taxes goes toward unemployment insurance, revenue from FICA goes toward Social Security and Medicare benefits.

If you run a small business, it’s important to stay on top of your FUTA taxes. Missing deadlines or making mistakes can result in costly fees.

To help you stay in compliance, here are some best practices for handling your FUTA taxes:

Your company can potentially earn a 5.4% tax credit if you submit SUTA taxes on time. This is a 90% reduction in the FUTA tax and a huge incentive to meet all tax filing deadlines during the year. If you fail to meet due dates, you may face penalties from the IRS.

If you’re a small business owner, figuring out what FUTA is and calculating payroll obligations are likely the last things you want to deal with. In some cases, determining your tax liability can be confusing.

Payroll software like QuickBooks Payroll keeps your payroll information in one place, so you can easily organize and manage it. Plus, it allows you to calculate and file SUTA and FUTA taxes, helping you stay in compliance and avoid penalties.

QuickBooks Online Payroll & Contractor Payments: Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services, subject to eligibility criteria, credit, and application approval. For more information about Intuit Payments Inc.’s money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/

The standard FUTA tax rate for 2024 remains at 6.0% on the first $7,000 of wages.

What is the maximum FUTA credit reduction?The maximum credit reduction you can receive for FUTA is 5.4%, which can lower your FUTA tax expectations from 6% to 0.6%.

When can employers roll over taxes?If the payroll liability for FUTA results in $500 or less for the quarter, then you can roll it over to the next quarter.

Recommended for you

FICA: What is FICA tax?

8 common tax audit triggers to avoid

Salary vs. owner's draw: How to pay yourself as a business owner

December 14, 2020

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

**Product information

QuickBooks Live Assisted Bookkeeping: This is a monthly subscription service offering ongoing guidance on how to manage your books that you maintain full ownership and control. When you request a session with a Live Bookkeeper, they can provide guidance on topics including: bookkeeping automation, categorization, financial reports and dashboards, reconciliation, and workflow creation and management. They can also answer specific questions related to your books and your business. Some basic bookkeeping services may not be included and will be determined by your Live Bookkeeper. The Live Bookkeeper will provide help based on the information you provide.

QuickBooks Live Full-Service Bookkeeping: This is a combination service that includes QuickBooks Live Cleanup and QuickBooks Live Monthly Bookkeeping.

1. QuickBooks Online Advanced supports the upload of 1000 transaction lines for invoices at one time. 37% faster based off of internal tests comparing QuickBooks Online regular invoice workflow with QuickBooks Online Advanced multiple invoice workflow.

2. Access to Priority Circle and its benefits are available only to customers located in the 50 United States, including DC, who have an active, paid subscription to QuickBooks Desktop Enterprise or QuickBooks Online Advanced. Eligibility criteria may apply to certain products. When customers no longer have an active, paid subscription, they will not be eligible to receive benefits. Phone and messaging premium support is available 24/7. Support hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. holidays and events beyond our control. Intuit reserves the right to change these hours without notice. Terms, conditions, pricing, service, support options, and support team members are subject to change without notice.

3. For hours of support and how to contact support, click here.

4. With our Tax Penalty Protection: If you receive a tax notice and send it to us within 15-days of the tax notice we will cover the payroll tax penalty, up to $25,000. Additional conditions and restrictions apply. See more information about the guarantee here: https://payroll.intuit.com/disclosure/.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

QuickBooks Money: QuickBooks Money is a standalone Intuit offering that includes QuickBooks Payments and QuickBooks Checking. Intuit accounts are subject to eligibility criteria, credit, and application approval. Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. QuickBooks Money Deposit Account Agreement applies. Banking services and debit card opening are subject to identity verification and approval by Green Dot Bank. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

QuickBooks Commerce Integration: QuickBooks Online and QuickBooks Commerce sold separately. Integration available.

QuickBooks Live Bookkeeping Guided Setup: The QuickBooks Live Bookkeeping Guided Setup is a one-time virtual session with a QuickBooks expert. It’s available to new QuickBooks Online monthly subscribers who are within the first 30 days of their subscription. The QuickBooks Live Bookkeeping Guided Setup service includes: providing the customer with instructions on how to set up chart of accounts; customized invoices and setup reminders; connecting bank accounts and credit cards. The QuickBooks Live Bookkeeping Guided Setup is not available for QuickBooks trial and QuickBooks Self Employed offerings, and does not include desktop migration, Payroll setup or services. Your expert will only guide the process of setting up a QuickBooks Online account. Terms, conditions, pricing, special features, and service and support options subject to change without notice.